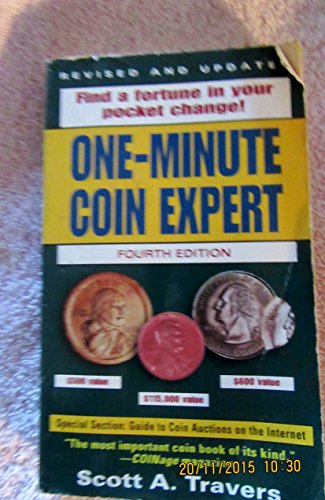

Items related to The One-Minute Coin Expert, 4th Edition

¸ a new chapter devoted to America's new coins

¸ dozens of photographs that show the varieties of new coins that are worth hundreds of dollars each and are hiding in your pocket change

¸ how to identify the perils and pitfalls of Internet coin auctions

¸ how to grade and trade coins like the professionals

¸ the right way to handle and store your coins

¸ valuable insider tips

One-Minute Coin Expert is the essential tool that could help you turn your pocket change into a treasure!

"synopsis" may belong to another edition of this title.

-- Vincent Sgro, Bloomberg News

"The most important coin book of its kind."

-- COINage magazine

YOU CAN BE AN EXPERT

This is a book on how to become an expert on coins.

Expertise on coins can take many forms. It can mean becoming adroit at checking pocket change for coins that will bring you a financial windfall. It also can mean becoming astute at spending money on coins, whether you’re reaching into your pocket for one hundred dollars to buy a rare coin, or even reaching deep into your bank account for many thousands of dollars to spend on extremely rare coins in hopes of achieving a profit.

Whatever your degree of involvement, this book will make you an expert. And if you become an expert, you can profit from rare coins at every level of involvement, regardless of whether current market conditions are good or bad.

At one time or another, possibly without even realizing it, just about everyone thinks about coins as an investment. It happens, for example, when a really old coin turns up in your change or in your travels, or when you get a coin that just doesn’t look right—one, for example, on which the date and some of the words are misprinted.

Many of us have had this experience. And when it happens, we invariably want to know two things: What’s it worth, and will I make more money if I sell it now or later?

You don’t have to wait for scarce and valuable coins to come along; you can go looking for them. And you can make money by buying and selling scarce coins. Many such coins today are authenticated and graded by independent experts and then encased in special plastic holders. This process assures the buyer that the grade, or level of preservation, is being properly stated by the seller. “Certified” coins change hands readily on nationwide trading networks and greatly enhance the appeal of rare coins to traditional investors.

I’ve come up with simple, easy-to-follow guidelines that will take you step by step through the process of identifying good values at all levels of the coin-buying spectrum. Follow these steps and you’ll not only know what to look for, but also what to do with the coins once you have them.

Coins go up and down in value frequently; the coin market has peaks and valleys. But I’ll show you how to make money in all kinds of markets—when coins are red-hot and also when prices are in a tailspin. That, after all, is the sign of a real expert: knowing how to thrive whether the coin market is rallying or is in one of its characteristic cyclical downturns.

WHY PEOPLE ACQUIRE COINS

People save coins for a number of different reasons. Some find them appealing as miniature works of art. Others are intrigued by the rich historical significance they possess. Many simply enjoy the challenge of pursuing something rare, elusive, and valuable. And, not least of all, many are attracted by the marvelous track record rare coins have achieved as good investments. Obviously, a great many people collect rare coins for all these different reasons, to a greater or lesser degree.

Finding something valuable is understandably thrilling, and many scarce coins do turn up in ordinary pocket change. I’ll furnish a list of such coins in Chapter Two. Realistically, though, many rare coins have to be purchased.

Billions of dollars are spent on rare coins every year, and U.S. coins are by far the biggest segment of that market. In large part, that’s because Americans account for the single biggest group of collectors in the world, as well as being among the most affluent. But other factors also have a bearing. For one thing, U.S. coins require less in-depth knowledge than ancient coins or international coins from the modern era. For another thing, the U.S. coin market is an easy-entry, easy-exit field with no regulation by the government—and many entrepreneurs find this appealing.

THE COIN BUYER SPECTRUM

The rare coin market is really a spectrum of different kinds of buyers. While one group of buyers may have different motivations from other groups, all are integral parts of the overall market—and all, in a real sense, are interdependent.

We can better understand who buys and saves coins, and why, by looking at the following graphic:

Accumulators—Accumulators are people who save coins haphazardly, without a particular pattern or plan of action. Many are undoubtedly attracted by the same positive qualities that motivate collectors and investors: the physical appeal of the coins and the notion of selling them for a profit, for example. But these objectives are only vaguely defined.

An accumulator may have sugar bowls or jars filled with coins, but they’re probably not arranged in any special order and he probably doesn’t have a very good idea what they’re worth—even though some of them may be worth a great deal.

Collectors—In theory, a collector is someone who purchases coins with no regard at all for their profit potential—someone who is motivated strictly by such factors as aesthetics and historical significance. If a collector purchased a coin for $100 and its value went up to $1,000, he wouldn’t even consider selling that coin, since he wouldn’t have any interest in the coin’s financial aspects. Theoretically, a collector also wouldn’t concern himself with how much he had to pay to obtain a coin.

Collectors enjoy assembling coins in sets, and they strive for completeness in those sets. Lincoln cents with wheat stalks on the reverse were issued, for example, from 1909 to 1958. A collector would be interested in putting together representative Lincoln cents from each of those years so that she would have a complete set. Some collectors also like to assemble “type” collections, consisting of one coin from each of a number of different series. A twentieth-century type set of U.S. coins, for instance, would include one example of every different U.S. coin issued since 1901. A “type” coin is a representative example of a major coin variety but not a rare date of that variety.

Investors—On the other end of the spectrum, at the right-hand side of our graphic, is the investor. Unlike the collector, the investor pays close attention to inflation, interest rates, the size of the money supply—and, in short, the economic justification for purchasing rare coins. The quintessential investor, in fact, would be concerned only with profit, and not at all with coins’ aesthetics and history.

Collector/Investors—In practical terms, no one is ever a totally solid collector or solid investor. Even the most dedicated collectors can’t be completely oblivious to the cost and the value of their coins. And even the most profit-oriented investor can’t completely ignore the intangible allure of beautiful coins.

The collector/investor combines the best of both worlds. This is a person who buys coins not only for their cultural, historical, and artistic appeal, but also to make a profit. The collector/investor represents a new breed of coin buyer, and a very healthy one.

OLD-TIME COLLECTING

Years ago, many people set aside interesting coins: circulated coins they found in pocket change, rolls of brand new coins they obtained at face value from the bank, or possibly government proof sets they purchased for modest premiums from the Mint. These coins may not have been particularly valuable at the time, but over the years coin collecting has evolved from a small hobby into a big business. And today, these tiny treasures may very well command enormous premiums.

As with anything else, it’s a matter of supply and demand. Many of these coins, rolls, and proof sets have been in small supply since the day they were made. But years ago, the number of collectors was also relatively small, so demand for these coins remained at moderate levels. That served to hold down their prices.

Coin collecting became much more popular in the early 1960s. Thousands and thousands of newcomers started looking for low-mintage coins in their pocket change; many would go to the bank and get rolls of coins every week, then take them home and pick out the scarcer pieces. During that period, many people also began to purchase proof sets from the government every year. The expansion continued and accelerated during the 1970s and into the 1980s.

THE COMING OF THE INVESTOR

Investors began to enter the coin market in large numbers in the mid to late 1970s. The timing was no accident: Coins, like precious metals, have come to be viewed as hedges against economic calamities, and the late 1970s were years of unusual turbulence economically. Inflation was on the rise and many people were skeptical of the government’s ability to control it. They also were wary of conventional investments such as stocks. Driven by these fears, many turned to tangible assets and diverted large sums of money into gold, silver, and other such investments—including coins. Some combined their interest in coins and precious metals by buying bullion coins. These are coins whose value goes up or down in accordance with the value of the metal they contain—usually gold or silver. We’ll discuss these in greater detail in a later chapter.

During the period ending in early 1980, the coin market experienced the most tremendous boom it has ever enjoyed.

THE GROWTH OF COLLECTING/INVESTING

As the number of collectors and investors expanded, so did the demand for better-date coins. The results were entirely predictable: As market demand increased for a fixed (and small) supply, prices began to escalate dramatically. At the same time, more and more people began to approach rare coins as both a collecting outlet and an investment.

Many collector/investors are baby boomers grown up: people who possibly started collecting coins when they were twelve or thirteen years old and built a solid foundation, then took a hiatus to pursue other interests such as college, courtship, and careers...

"About this title" may belong to another edition of this title.

- PublisherHouse of Collectibles

- Publication date2001

- ISBN 10 0609807471

- ISBN 13 9780609807477

- BindingMass Market Paperback

- Number of pages368

- Rating

Buy New

Learn more about this copy

Shipping:

US$ 5.45

Within U.S.A.

Top Search Results from the AbeBooks Marketplace

The One-Minute Coin Expert, 4th Edition

Book Description Mass Market Paperback. Condition: New. In shrink wrap. Seller Inventory # 100-11540

The One-Minute Coin Expert, 4th Edition

Book Description Paperback. Condition: new. New. Fast Shipping and good customer service. Seller Inventory # Holz_New_0609807471

The One-Minute Coin Expert, 4th Edition

Book Description Paperback. Condition: new. Brand New Copy. Seller Inventory # BBB_new0609807471

The One-Minute Coin Expert, 4th Edition

Book Description Paperback. Condition: new. New. Seller Inventory # Wizard0609807471

The One-Minute Coin Expert, 4th Edition

Book Description Paperback. Condition: new. New Copy. Customer Service Guaranteed. Seller Inventory # think0609807471

THE ONE-MINUTE COIN EXPERT, 4TH

Book Description Condition: New. New. In shrink wrap. Looks like an interesting title! 0.38. Seller Inventory # Q-0609807471